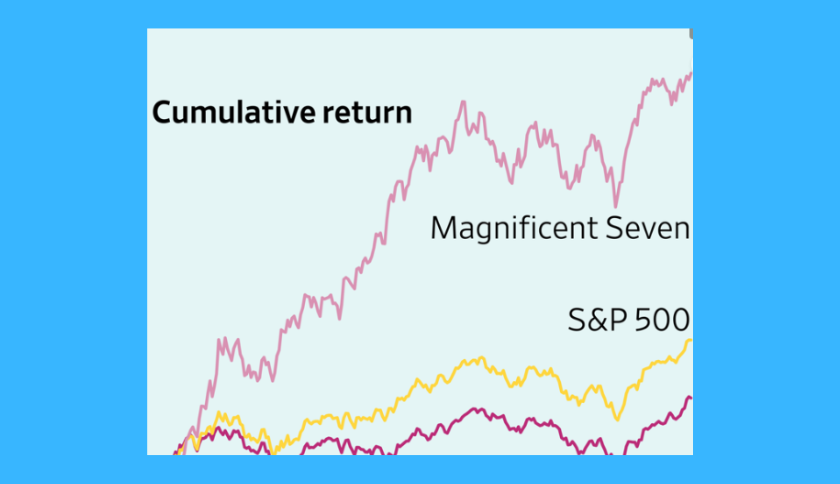

Big tech stocks reclaimed their function because the marketplace’s leaders this year. Just how far in advance of the percent have they run?

Together, the stocks referred to as the extraordinary seven—apple, microsoft, alphabet, amazon.Com, nvidia, tesla and meta structures—have jumped 75% in 2023, leaving the other 493 agencies in the s&p 500 in their dirt. (those have risen a extra modest 12%, while the index as an entire is up 23%.)

The outstanding seven shares have swelled to symbolize about 30% of the s&p 500’s market value, in step with goldman sachs international funding research. That is drawing close the highest-ever proportion for any seven stocks.

“it’s a mind-blowing wide variety to me after I consider an index that’s supposed to constitute one of these broad organization of corporations,” said ann miletti, head of active equity at allspring international investments, of the extensive outperformance hole.

The influence of the big tech stocks is massive on a worldwide scale, too. Inside the msci all country international index—a benchmark that claims to cowl about 85% of the global investible fairness marketplace—the combined weighting of the dazzling seven is greater than that of all of the shares from japan, france, china and the u.Okay.

Buyers and strategists have lengthy raised issues about market concentration. When only a handful of stocks are responsible for maximum of the market’s gains, it will become more liable to a downturn if some heavyweights fall.

The ones worries appeared prescient closing 12 months whilst massive tech stocks tumbled because the federal reserve commenced raising hobby fees. While fees have been close to zero, investors chased the strong returns provided by using tech and other increase stocks, but whilst rates began rising, those stocks all at once faced opposition from much less-risky investments.

The superb seven finished 2022 down 40%, losing $four.7 trillion in blended market price, while the ultimate shares inside the s&p 500 dropped 12%.

Most buyers expected more of the equal in 2023. As an alternative, massive tech launched into a furious rally that overcame a banking-zone crisis, issues approximately a central authority debt default and wars inside the center east and europe.

In the back of the blockbuster profits? Synthetic-intelligence hype took wall avenue by way of typhoon, bolstering hopes that those groups could generate providence profits within the future. Plus, robust monetary data, coupled with easing inflation, powered bets that interest rates have peaked, offering tech shares another boost.Microsoft has rallied 55% in 2023, with stocks placing report highs in november. Apple has brought 52% and in june have become the primary u.S. Employer whose valuation eclipsed $3 trillion. Nvidia stocks have more than tripled, pushing its market price above $1 trillion.