This has been a very good 12 months for stocks, no doubt approximately that. The s&p 500 has won 19% year-to-date, after a gangbusters november, and the outlook for december, even as more slight, remains nice.

The markets have made these profits regardless of a robust set of headwinds, November of the federal reserDecembern to a policy of aggressive monetary tightening and hobby fee hikes; the continued struggle in ukraine; and now the flare-up of battle within the Middle East. This stock rally is showing actual power, and the road is now taking significantly the opportunity of a ‘gentle landing’ case, with inflation falling to the fed’s goal rate of two in the coming 12 months.

That’s fueling some development in investor sentiment – and a brighter outlook from the experts. Writing from Bank of us, marketplace strategist savita subramanian says in a recent Be Aware, “We are beyond maximum macro uncertainty… we’re bullish now not due to the fact we count on the fed to reduce, but Subramanian what the fed has completed. Corporations have adapted to better charges and inflation.”

Putting some numbers to the sentiment, subramanian is predicting that the s&p will hit five,000 throughout 2024 – a new report high, and a few nine. Five above its cutting-edge stage.

That coSubramaniangain is well worth pursuing, and the financial institution of the United States analysts are doing simply that – selecting shares in all likelihood to trip a bullish sentiment wave. Here are some of them, along with the modern stats from the Tipranks database and comments from a financial institution of America’s stock experts.

First up on our list of the financial institutions in the united States’ selections is arrowhead pharma, a scientific research corporation operating with RNA interference, or RNAi, a mechanism to goal particular genes involved in the expression of uncommon and/or intractable sicknesses. The enterprise has an extensive-ranging portfolio of RNA chemistries, primarily based on diverse modes of transport, and has used those to create a chain of RNAi-based therapeutic agents.

The gain right here comes from the movement of rnai; the mechanism is found in all dwelling cells and inhibits the expression of precise genes, stopping or altering the manufacturing of proteins assocRNAid with the one’s genes. The excessive specificity of the mechanism makes it uniquely appropriate for the remedy of genetically-based diseases.

Following this path, arrowhead has evolved a proprietary drug improvement platform, dubbed trim, or centered rnai molecule, to apply ligand-mediated delivery for tissue-precise concentrated on from a structurally easy healing agent. The employer has built up an extensive pipeline of drug candidates, focused on situations as various as Nash and other liver sicknesses, gout, hepatitis, and myotonic dystrophy – it’s a protracted list because the enterprise has 15 lively studies tracks ongoing.

The most superior pipeline task is plozasiran, a potential treatment for the cardiac circumstance hypertriglyceridemia. The drug candidate is on the overdue stage of clinical trials, and the company currently released nice clinical statistics from the segment 2 shasta-2 and muir research. The related drug, zodasiran, is the difficulty of the arches-2 take a look at; arrowhead launched data on this at the same tiShasta-2ozasiMuirreleases.

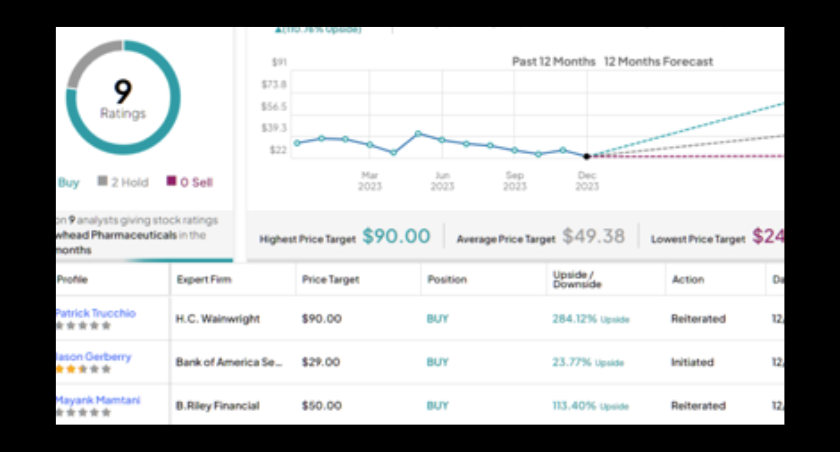

For Bank of the usa analyst jason gerberry, this enterprise’s giant pipeline, together with a few solid late-stage assets, adds up to a sound funding. Laying out the info, Burberry JasonsBurberryr view, arwr has an appealing blend of early to late packages with full-size upside capacityWe view the modern inventory valuation as an appealing access point given Arrowhead’s progress in developing pulmonary-primarily based rnai treatments, organising a capability first-mover advantage in massive markets. We see numerous ability 2024 catalysts on the way to help validate plozasiran (for cardorganizing ailment) and biomarker data for aro-rage, the lead respiration software. Even as the 4q24 coins runway creates a stock overhang, we see publish quarter sell-off as overdone given ’24 medical updates + potential to monetize sure platform property to increase cash runway in a non-dilutive way.”