All eyes have been on artificial intelligence (ai) stocks in 2023, with the market nearly singlehandedly triggering a healing for the nasdaq composite after it plunged extra than 30% final yr.

Macroeconomic headwinds curbed purchaser and business spending in 2022, leading to a sell-off. However, the release of openai’s chatgpt in november 2022 made wall road bullish about tech stocks once more, with countless companies restructuring their corporations to attention on the era. As a end result, the index has soared 43% due to the fact jan. 1.

In line with grand view studies, the ai marketplace is valued at $137 billion, however is projected to exceed $1 trillion through the quit of the decade, expanding at a compound annual growth rate of 37%. The considerable increase capability indicates it is now not too late to spend money on this budding industry and profit from its long-time period development.

Right here are two no-brainer ai stocks to buy before 2024.

Superior micro gadgets

Shares of advanced micro gadgets (nasdaq: amd) have soared a hundred and fifteen% year to date. Chipmakers enjoyed the maximum inventory increase amid the ai excitement, as their hardware is critical for education and walking ai fashions. In truth, amd’s biggest competitor, nvidia, has seen its stocks upward thrust greater than two hundred% this year alongside a spike in chip sales.

Amd’s financials have not begun to mirror its capacity within the region, with its information middle sales virtually dipping simply beneath 1% 12 months over yr in the 0.33 quarter of 2023. However, that would all trade in 2024, whilst the corporation will begin transport what it calls its most powerful photographs processing unit (gpu) ever, designed especially to compete with nvidia’s services.

Amd’s new ai gpu, the mi300x, comes at a time whilst the marketplace has grown determined for options to nvidia, with organizations searching forward to accelerated competition lowering the value of chips. As a end result, if the chipmaker can supply higher price-to-performance, it is able to have a real shot at taking a widespread bite out of nvidia’s estimated 90% marketplace proportion in ai chips.

The mi300x is already off to a promising begin, with microsoft’s azure announcing in november that it’d end up the first cloud platform to apply the gpu to amplify its ai abilties. In the meantime, amd has partnered with meta, cisco, and broadcom to build superior ai structures.

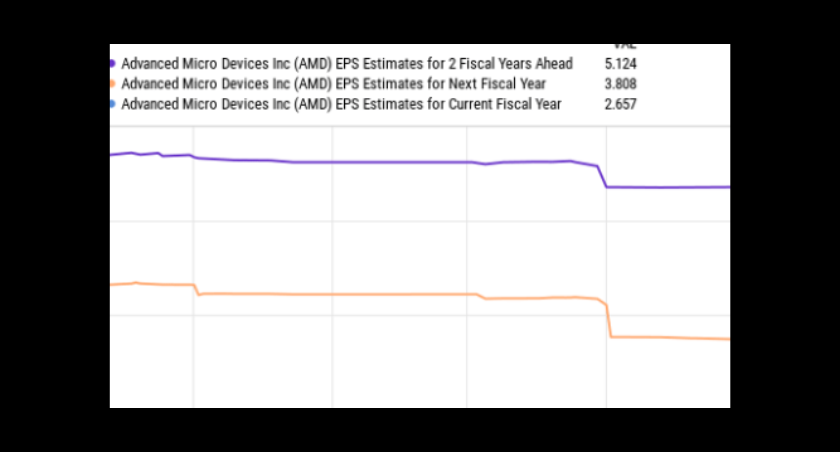

Amd’s soaring stock rate, alongside profits that haven’t begun to see a go back on its investment in ai, has made its stocks steeply-priced, illustrated via the enterprise’s forward fee-to-earnings ratio (p/e) of about fifty two. However, eps estimates advise the employer nonetheless has plenty to provide new traders.

This chart suggests amd’s earnings ought to hit $5 consistent with percentage over the next two financial years. Multiplying that parent by means of the chipmaker’s forward p/e yields a stock price of $265, projecting increase of 90% over the subsequent two financial years.

Therefore, amd’s inventory is attractive ahead of 2024, and a no brainer for everybody seeking to invest in ai.

Alphabet

Even as amd appears probably to shake up the ai chip market next year, alphabet (nasdaq: goog) (nasdaq: googl) might be poised to peer huge profits from the software side of the enterprise.

In early december the company unveiled its fairly anticipated massive language version, gemini. In line with ceo sundar pichai, the brand new version “represents one among the largest science and engineering efforts we’ve undertaken as a agency.” the brand new version is expected to be competitive with openai’s chatgpt-four, and capable of crunching diverse sorts of records which includes text, video, and audio.

Gemini will in all likelihood open the door to limitless boom possibilities in ai. The advanced model and in-residence brands like google, android, and youtube could prove a effective mixture. Alphabet will have the tech to provide greater efficient advertising and marketing thru google seek and youtube, create a search revel in closer to chatgpt, introduce ai functions on its diverse productiveness structures, enlarge its variety of ai gear on google cloud, and extra.

Those charts display the ahead price-to-profits ratios (p/e) and rate-to-loose coins float for some of the most outstanding names in ai proper now. Alphabet has the lowest figures for each metrics, indicating its stock is currently offering the maximum value.

Along loose coins glide that crowned $78 billion this 12 months and a newly launched ai model, alphabet is an exciting manner to invest inside the burgeoning zone. It has the budget to gas r&d, and is probably the biggest bargain in ai. The agency’s inventory is a screaming purchase in advance of the new year.